Our Sustainability & ESG Philosophy

At Renaissance Partners (RP), we are committed to integrating Environmental, Social, and Governance (ESG) factors across all stages of our investment process. We believe that these factors are essential drivers of long-term value and risk management. Our approach is based on the belief that responsible investment is key to enhancing performance and fostering sustainable growth.

Since our inception in 2015 until 2025, RP was part of the Neuberger Berman Group (NB). Under NB’s guidance, the investment team of RP’s investment strategy and the ESG Team have acquired skills and knowledge on sustainability and ESG principles with a solid commitment to financial performance and responsible investing.

Renaissance Partners Sustainability & ESG strategy encompasses a disciplined integration of ESG considerations into the investment lifecycle, from sourcing to exit. We focus on aligning our investments with sustainable practices, aiming to drive positive change and create value for all stakeholders. We believe we have the opportunity and responsibility to advance our ESG efforts and foster best practices across the business community through active ownership.

Discover more about our sustainability and ESG vision and how we strive to stay "one-step-ahead" in the private equity industry in the next video.

Renaissance Partners: an Investment Strategy Managed

by Renaissance AIFM

Renaissance Partners is a private equity investment strategy managed by Renaissance AIFM S.à r.l, a Luxembourg based investment manager regulated by the Commission de Surveillance du Secteur Financier (CSSF). The AIFM recognizes that integrating material sustainability factors is essential for long-term value creation in the financial markets sector. Sustainability and ESG initiatives — such as fostering positive environmental impact, upholding human rights, promoting ethical conduct and maintaining fairness and accountability in decision making — are key elements to preserve and create value within the investment portfolios managed by the AIFM. Renaissance embraces sustainable practices, believing that embedding financially material ESG factors supports the resilience of portfolios, helping to mitigate downside risks and enhance value creation opportunities.

Read our full Renaissance Responsible Investment Policy

Learn more about how we are integrating ESG considerations

within our investment process. Download

Read the Full Renaissance AIFM

Sustainability Policy

Learn more about how Renaissance is adopting sustainable practices

and integrating ESG factors in portfolio management.

Download

Read our full Renaissance Responsible Investment Policy

Learn more about how we are integrating ESG considerations

within our investment process. Download

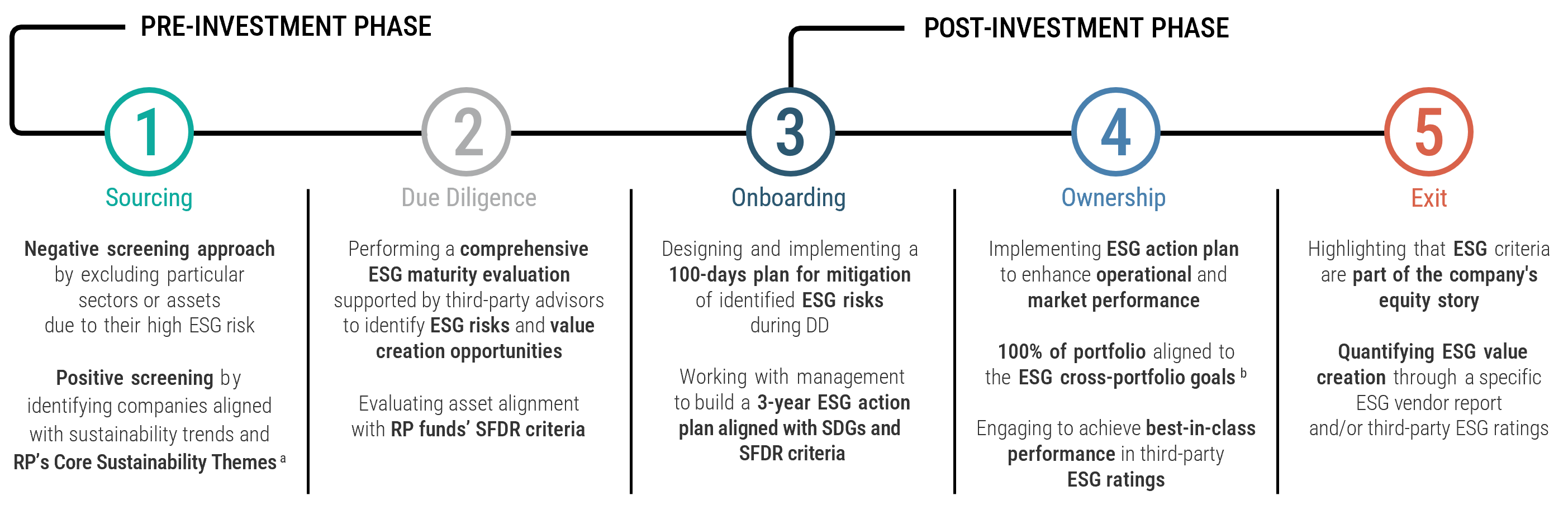

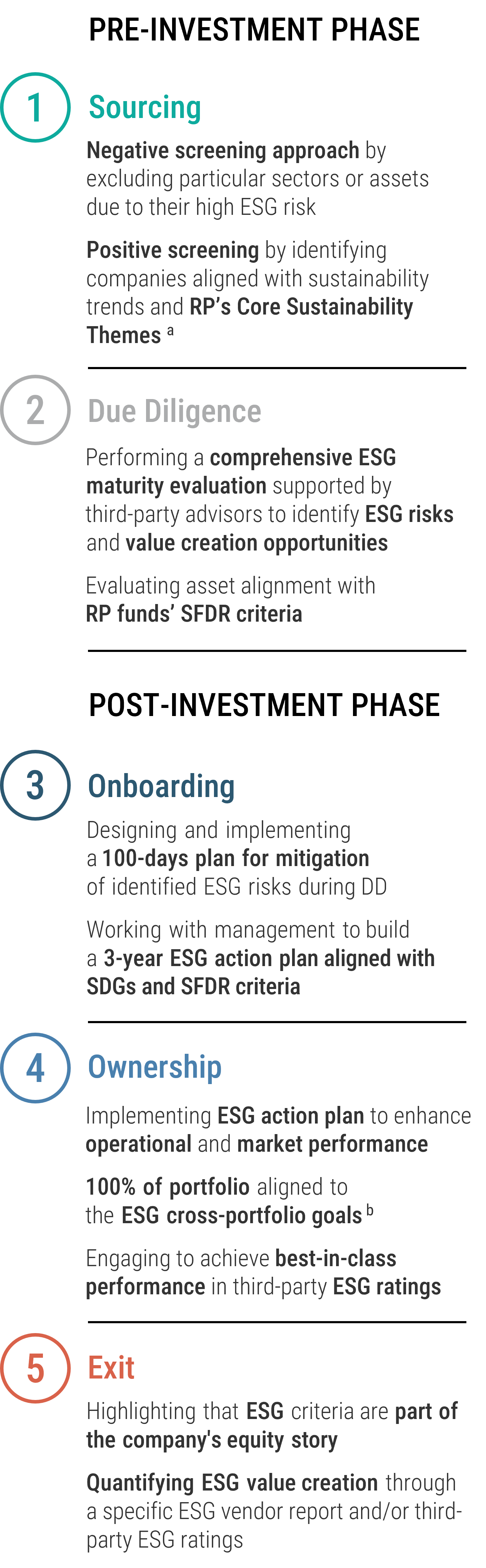

Renaissance Partners Proprietary Responsible Investment Approach

As part of Renaissance AIFM, we meticulously integrate a responsible investment approach across every stage of the investment cycle. This approach is detailed during two pivotal phases: (i) the pre-investment phase, which encompasses the sourcing, comprehensive due diligence, and execution of investment decisions, and (ii) the post-investment phase, which begins once the transaction concludes, covering the onboarding, active ownership, and exit stages. Our methodical approach to responsible investment is underscored by the integration of ESG factors within each critical phase, as illustrated in the figure below:

a The Core Sustainability Themes represent the key areas that RP prioritizes to drive sustainability outcomes and positively contribute to the SDGs through its investments.

b The ESG cross-portfolio goals are: i) Structure an annual sustainability report in line with GRI/ESRS Standards; ii) Appoint an ESG role within the operating structure; iii) Establish an ESG Committee to oversee the implementation of the company’s sustainability plan; iv) Define a 3-year ESG value creation plan with a dedicated budget and responsibilities; v) Perform third party periodic assessments and obtain third-party ESG ratings (e.g., EcoVadis); vi) Integrate ESG KPIs in senior management MBO.

Read our Full Renaissance Partners

Responsible Investment Policy

Learn more about how RP is integrating ESG considerations

within its investment process.

Download

Read our full Renaissance Responsible Investment Policy

Learn more about how we are integrating ESG considerations

within our investment process. Download

Renaissance Partners Sustainability & ESG

Oversight and Implementation

At Renaissance we are at the forefront of responsible investing, having established a comprehensive ESG governance and oversight structure, and clearly outlining roles and responsibilities to support its commitments and strategy.

The Renaissance ESG Committee, established at the AIFM level and led by Renaissance ESG Practice Leader, is responsible of providing strategic direction in terms of the GP’s responsible investment approach and is accountable for the oversight of the responsible investment policies for the different investment strategies managed by the AIFM. The ESG Committee is composed of the ESG Practice Leader, ESG Manager, senior members of the investment team, Head of Investor Relations and representatives of the AIFM’s control functions. The investment team, supported by the ESG team, is responsible for the implementation of the RP Responsible Investment Policy within the pre- and post-investment activities and for periodically reporting to the Renaissance ESG Committee the compliance to such policy.

The Renaissance ESG Team is responsible for supporting the strategic definition and implementation of the funds’ ESG strategies in line with the provisions of the ESG Committee. This includes setting the overall direction, assisting investment teams in implementing ESG policies and plans, and ensuring regulatory compliance. The team also drives ESG initiatives, monitors performance, prepares key disclosures, and responds to investor requests.

Andrea Vallini

Operating Partner and

Sustainability & ESG

Practice Leader

Paloma Lopez Imizcoz

Sustainability & ESG Manager

Tommaso Cortecci

Sustainability & ESG Analyst

Renaissance Partners ESG Annual Report

Since 2019, RP is committed to active ESG KPI monitoring and disclosure from portfolio companies. Annually we monitor and report more than 40 KPIs for each portfolio company based on recognized standards such as GRI (Global Reporting Initiative), EDCI (ESG Data Convergence) and TCFD (Taskforce on Climate-related Financial Disclosures).

Read our full Renaissance Responsible Investment Policy

Learn more about how we are integrating ESG considerations

within our investment process. Download

Read our Renaissance Partners

2024 ESG Annual Report

Learn about how we are building responsible businesses and creating

portfolio value through ESG.

Download our 2024 Annual ESG Report

2023 ESG Report

2022 ESG Report

2021 ESG Spotlight

2020 ESG Spotlight

2019 ESG Spotlight

ESG Highlights of Portfolio Companies

Cross-portfolio ESG Goals as of March1

100% of Portfolio Companies structure a corporate sustainability report in line with GRI and/or ESRS Standards.

100% of Portfolio Companies have appointed an internal role for leading ESG initiatives within the company.

100% of Portfolio Companies have defined a 3-year ESG value cration plan with dedicated budget and responsibilities.

100% of Portfolio Companies have established a corporate ESG Working Group/Committee to manage the ESG value creation plan.

90% of Portfolio Companies have conducted a periodic third-party evaluation and secured an ESG rating (e.g., EcoVadis).

35% of Portfolio Companies have integrated ESG KPIs in senior management MBO.

Fund III ESG highlights2

87% of Investments implemented circular economy initiatives.

59% of Investments are designing/designed a decarbonisation plan, in line with the Paris Agreement.

89% of Investments performed an ESG training program for employees.

100% of Investments have a Welfare Program in place.

100% of Investments have a privacy policy and GDPR-related procedure.

68% of Investments have a code of conduct for suppliers.

Access Portfolio Companies’ Latest Sustainability Reports

Click on each logo to view the latest corporate sustainability report

Industry Collaboration

We recognize our responsibility to help advance the private equity industry by promoting the wider adoption of responsible investing practices.

We believe the most effective way to drive progress is through collaboration with clients and others in the investment industry, engaging with individual companies and sector associations to conduct joint research on ESG issues and support the development and adoption of industry-standard ESG disclosures and tools.

We are a strong supporter of sustainability initiatives in private equity markets and are active in the following industry-wide initiatives:

We have been a signatory since inception of the UN Global Compact (UNGC) under the Neuberger Berman umbrella, committed to proactively support the Ten Principles in the areas of human rights, fair labour conditions, environmental protection and anti-corruption. Starting from 2025, Renaissance AIFM has become an independent signatory of the UN Global Compact.

We are a supporter of the recommendations of the Task Force on Climate Related Financial Disclosure (TCFD). Guided by the TCFD’s four pillars—Governance, Strategy, Risk Management, and Metrics & Targets—we have adopted a structured methodology to identify, assess, and manage climate-related physical and transitional risks and opportunities. Please refer to our latest Annual ESG Report to review RP’s TCFD disclosures.

We are committed to aligning the investment portfolio with the Science Based Targets initiative (SBTi) guidelines to reduce greenhouse gas emissions, in accordance with the Paris Agreement. By engaging with SBTi through our portfolio companies, we promote the alignment of their decarbonization plans to the SBTi methodologies demonstrating our commitment to the transition to a low-carbon economy. Through setting and validating corporate science-based targets, we aim to contribute to the global effort to limit warming to 1.5°C above pre-industrial levels while reducing our portfolio exposure to climate-related risks.

Since 2022, we have been actively participating in the ESG Data Convergence Initiative (EDCI), which seeks to harmonize and streamline ESG data for private capital markets. By contributing to this initiative, we support the creation of a standardized framework for ESG metrics, facilitating better transparency and comparability across the industry

In 2024, we proactively collaborated with the CSB of NYU Stern by piloting the Sustainability Value Framework Tool. This tool, developed by the CSB, assists in analysing ESG-related risks and opportunities for new investments, linking them to concrete financial and market upsides and downsides. Following the pilot's success, the tool has been integrated into Renaissance Partners ESG integration process to enhance our ESG integration framework and active ownership strategy.

Embracing the Principles for Responsible Investment (PRI)

Renaissance has been a signatory of the UN-supported Principles for Responsible Investment (PRI) since its inception in 2015 under the Neuberger Berman umbrella. Starting from 2025, we have become an independent signatory of the UN PRI with our first independent assessment to be published on the second half of 2025.

In the 2024 NB PRI Assessment, the Group scored above the median of all reporting signatories and of large investment management peers globally for our ESG integration efforts in every reported category3.

Selected PRI Modules | Neuberger Berman Ratings | Median Ratings of all Reporting Signatories |

|---|---|---|

Policy, Governance & Strategy* | ★★★★★ | ★★★ |

Indirect - Private Equity | ★★★★★ | ★★★ |

Confidence Building Measures | ★★★★★ | ★★★★ |

*Formerly Investment and Stewardship Policy

Sustainability-related Disclosures

In May 2018, the European Commission adopted its Action Plan on Financing Sustainable Growth, with the aim of reorienting capital flows towards sustainable investment, managing financial risks stemming from environmental and social issues, and fostering greater transparency in ESG reporting.

As part of this initiative, Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (“SFDR”) was published on 9 December 2019 and entered into force on 29 December 2019, with effective implementation starting from 10 March 2021.

Renaissance AIFM S.à r.l. is an alternative investment fund manager based in Luxembourg and regulated by the Commission de Surveillance du Secteur Financier (CSSF). In accordance with SFDR, Renaissance AIFM S.à r.l. provides the entity-level disclosures pursuant to Articles 3(1), 4(1)(b), and 5(1) of the Regulation. Please refer to the link below.

For sustainability-related disclosures under Article 10 SFDR, which relate to Renaissance AIFM’s Article 8 or 9 financial products, please refer to the product-specific documentation available through the respective investor portals or contact the AIFM directly.

For detailed information on Sustainability-related Disclosures, please refer to the next link:

1 Fund III ESG highlights have been calculated excluding Inetum.

2 2023 ESG performance for each KPI is compared to 2022 performance.

3 For illustrative and discussion purposes only. PRI grades are based on information reported directly by PRI signatories, of which investment managers totaled 3,123 for 2023, 2,791 for 2021, 1,545 for 2020, and 1,247 for 2019. All PRI signatories are eligible to participate and must complete a questionnaire to be included. The underlying information submitted by signatories is not audited by the PRI or any other party acting on its behalf. Signatories report on their responsible investment activities by responding to asset-specific modules in the Reporting Framework. Each module houses a variety of indicators that address specific topics of responsible investment. Signatories’ answers are then assessed and results are compiled into an Assessment Report. The underlying information has not been audited by the PRI or any other party acting on its behalf. While every effort has been made to produce a fair representation of performance, no representations or warranties are made as to the accuracy of the information presented, and no responsibility or liability can be accepted for damage caused by use of or reliance on the information contained within this report. Information about PRI grades is sourced entirely from PRI and Renaissance makes no representations, warranties or opinions based on that information.